Revoked Incorporated Entities

The following information is applicable only to incorporated, for-profit business entities. Revoked non-profit corporations can learn about the reinstatement process here. Trade names that have been involuntarily cancelled can submit a restoration request to return to good standing.

Incorporated businesses that fail to file an Annual Report, pay taxes, pay a required filing fee, maintain a registered agent, or maintain a registered office lose their good standing status with the RI Department of State – otherwise known as revocation.

Virtual office appointments are available to assist you with reinstating your business.

Click here to book an appointment!

What does revocation mean?

Revocation means that your business has lost good standing status with the RI Department of State. There are serious consequences to losing good standing status, including:

- Fines and penalties

- Loss of personal liability protection

- Loss of name rights

- Loss of legal rights

- Difficulty securing capital and financing

A revocation is not an official dissolution, which means your business will be liable for taxes and filings with the State of Rhode Island until you legally close it by filing the proper dissolution document with the RI Department of State. While your business remains in a revoked status, it will continue to owe annual reports to the RI Department of State and a minimum fee of $400 to the RI Division of Taxation each year. Entities that have been revoked for more than one year may lose the right to their name.

You can return your entity to good standing status through a process called “reinstatement.” The sooner you reinstate your business, the less you will pay in penalty fees. If you are no longer doing business and would like to legally close your business, you must file the appropriate dissolution form as part of your reinstatement packet. If you have questions about how revocation affects your business, please contact an attorney.

How to reinstate your business and return to good standing status:

The reinstatement process involves two different state agencies – the RI Division of Taxation AND the RI Department of State. Please follow the steps below.

RI Department of State

How do I know if my reinstatement was successful?

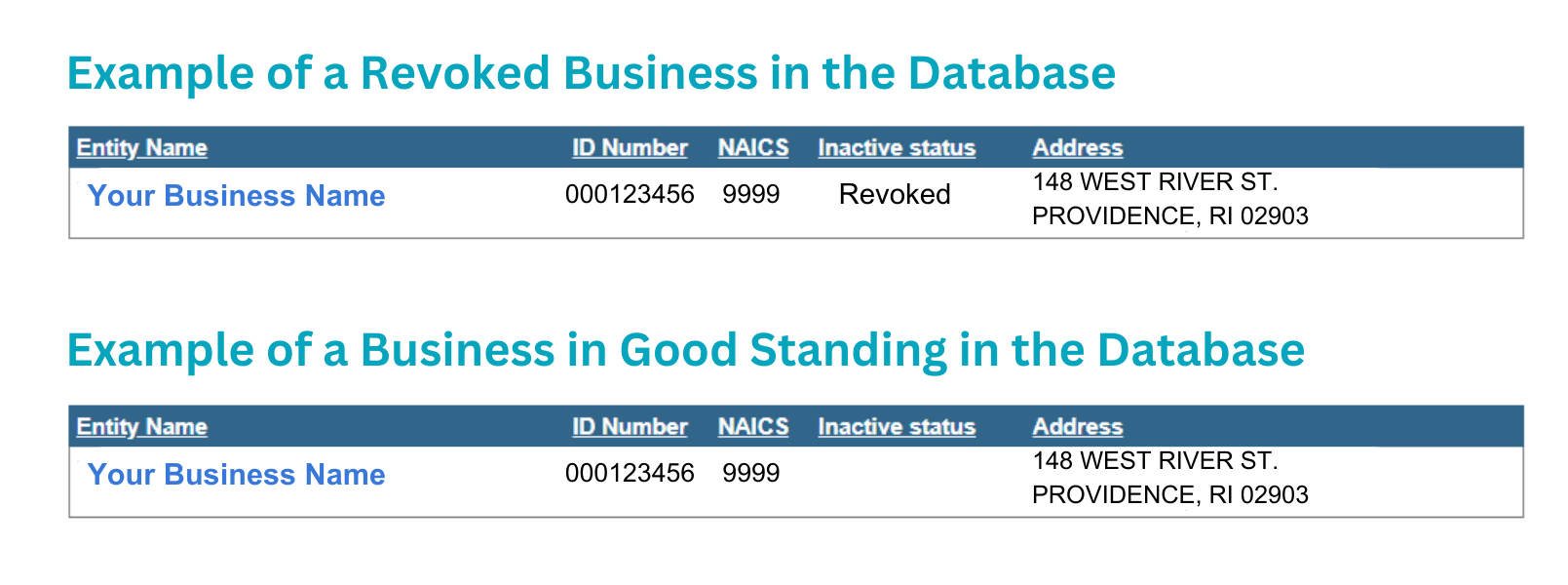

Once you have submitted a complete reinstatement packet to the RI Department of State, your filing will take between 2-4 business days to process. You will not receive an emailed or mailed confirmation that your filing was accepted. You can verify that your business has been reinstated by searching its name in our Corporate Database. In the search results, if the label “Revoked” has been removed from the column marked “Inactive Status,” your business has been successfully reinstated.